How MROs approached supply chain difficulties during the Covid-19 pandemic

David Pearl explores how several MROs approached supply chain and other challenges related to the pandemic, illustrating their fearless determination, adaptability, creativity, and willingness both to recognize and embrace new opportunities

Doing what everyone else believes can’t be done is in the DNA of people in the aviation industry. It’s why they love aircraft, and it’s why aircraft fly. These people don’t run from challenges; they thrive on them. They know that overcoming challenges and solving problems makes them better.

The Covid-19 pandemic is but the most recent significant challenge that has impacted the aviation industry as a whole.

The big picture

Kestrel Aviation of Kirkland, Washington, provides integrated aviation services to a wide range of aviation companies, including several maintenance, repair and overhaul companies (MROs). Kestrel Chief Executive Officer Steve Vella emphasized that the challenges associated with the pandemic were not unique. MROs routinely encounter supply chain pressures related to fluctuating demand. Any time the airlines experience a significant drop in revenue, they cancel or postpone purchases of new aircraft. Aircraft manufacturers, in turn, cut production and cancel orders from smaller companies and so on down the chain.

Vella noted that large companies like Boeing and Airbus have significant power and influence and apply this to their advantage whenever possible, ‘squeezing’ smaller companies for cost savings at every opportunity. The Covid-19 pandemic merely provided a convenient excuse to leverage these advantages.

As Vella observed, it takes but a moment for a Boeing or Airbus to cancel an order, but the ripple effects of that cancellation can be catastrophic for smaller companies down the supply chain. Suppliers who depend upon the big aviation companies may not survive a large-scale cancellation. “Shutting down operations is quick,” Vella stated, “but once a supplier leaves, it is very tough to come back. Unable to plan their future production, the supply chain breaks down.”

Vella witnessed this pattern repeatedly during the pandemic. Some smaller companies were forced into bankruptcy. As the world has emerged from the pandemic, he is encouraged that the pendulum appears to be swinging away from the big companies and back toward his primary clients. Air travel has rebounded, approaching and, in some instances, even surpassing pre-pandemic levels. The big companies can’t satisfy demand. They need the small companies again.

Air travel has rebounded, approaching and, in some instances, even surpassing pre-pandemic levels

Meeting this demand poses yet another challenge for suppliers. It will take time for companies to reestablish supply lines and, perhaps more importantly, rebuild trust up and down the chain. As always, it will be the consumer – the traveler – Vella believes, who will bear the brunt of the burden of increased costs and limited choices as the supply chain is restored.

Another factor that has contributed to the slow recovery from the pandemic is the large and growing backlog of Federal Aviation Administration (FAA) mandated inspections. Currently, companies must wait three to nine months for such inspections to be completed. They are prohibited from conducting business until those inspections are done. Consequently, many companies find themselves in the uncomfortable position of being all dressed up with no place to go.

In the trenches – the experiences of three MROs

StandardAero

Founded in 1911, StandardAero has grown into one of the world’s largest MRO providers, servicing business, commercial, military and private aviation clients. StandardAero’s helicopter unit works with clients in more than 85 nations and operates out of Florida, Texas, Colorado and North Carolina in the US. Peter Wheatley is the Vice President and General Manager of the Helicopter division.

Many of the key challenges the helicopter division faced in 2022 carried over to 2023. Wheatley cited back ordered parts as the primary reason for the on-going difficulties. “Many of our original equipment manufacturers (OEMs) are experiencing shortages of raw materials and, in some cases, personnel,” observed Wheatley. The situation likely will continue through 2023 and probably will worsen before it improves due to backlogged demand.

Parts delays are longer and more serious today than during the early days of the pandemic. Hot section components, especially turbine parts, are almost impossible to obtain. Shortages of engine parts cast from precious metals are common. Compounding these difficulties, rampant inflation has plagued the recovery at every turn in the pandemic’s wake. Aircraft parts were never cheap; now costs are becoming prohibitive.

Parts delays are longer and more serious today than during the early days of the pandemic

The helicopter division has met its hiring needs with a flexible approach, training personnel with a core curriculum that emphasizes cross-training to facilitate seamless shifts from one engine platform to another as needs dictate. Wheatley credited the division’s on-going efforts to add capacity and expand as opportunities arise both organically and through mergers with and/or acquisitions of other companies as a significant factor.

The division expanded its repair capabilities with an eye toward offering clients one stop shopping i.e. getting all needed repairs in one place. Additionally, by working more closely with engine OEMs, it has increased its readiness to meet the developing needs of its clients.

Looking ahead, Wheatley believes ‘robust pre-planning with direct input from customers will improve coordination of scheduled aircraft/engine downtimes, which is critical to long-term success.’ For the short-term, the StandardAero has purchased rental engines across various platforms to help customers bridge delays and is working closely with them to keep engines on wing as long as possible until materials availability improves. Operators are keeping engines and aircraft in service longer with the same goal in mind and are even utilizing Used Serviceable Material (USM) for repairs when possible.

Aero-Flite, a subsidiary of Conair

Conair, one of the world’s largest, fixed-wing aerial firefighting companies, is a Transport Canada Approved Maintenance Organization, performing comprehensive maintenance for the fleet of specialized aircraft in-house. Aero-Flite, a Conair subsidiary, is based in Spokane, Washington, and supplies large airtankers and water bombers to states across the US. The organization performs maintenance in-house on their fleet of more than a dozen aircraft.

Aero-Flite struggled to hire sufficient qualified personnel to maintain operations during the pandemic and its aftermath. Lack of adequate personnel, in turn, disrupted each link in Aero-Flite’s supply chain, compromising its ability to meet production. Ultimately, Aero-Flite had to move back delivery and production schedules. Compounding Aero Flite’s supply chain difficulties, international shipments encountered substantial delays while clearing customs.

But there is some reason for optimism amidst these difficulties. Mark Giovanardi, Aero-Flite’s Director of Materials, stated: “Because Aero Flite obtains parts from multiple sources for the special aircraft we operate, we are beginning to see our supply problems ease up. We have not gotten back to where we were before the pandemic, but we’re heading in the right direction.”

We have not gotten back to where we were before the pandemic, but we’re heading in the right direction

Giovanardi added: “We now plan one to two years out. This allows us enough time to complete our commitments efficiently and avoids problems associated with overly long lead times. This has kept production on track. We track our usage history continually and adjust our inventories accordingly. We do our best to anticipate unforeseen developments so we are prepared to deal with them.”

ACI Jet

Headquartered on California’s Central Coast since its founding in 1998, ACI Jet is a recognized leader in private aviation services. ACI Jet’s aviation ecosystem includes aircraft maintenance, aircraft ground support services, private jet charter services and aircraft management.

Dave Jensen, ACI’s Senior Vice President of Maintenance, acknowledged supply-chain disruptions like those described above. In the early days of the pandemic, Jensen remembers that maintenance activity increased because work was scheduled so far in advance. Customers seized the opportunity that the pandemic created to address their maintenance requirements.

Thereafter, ACI suffered painful delays in obtaining parts and in finding qualified people to fill open positions. Rather than accept this reality, however, and simply wait out the pandemic, ACI chose to act. Jensen believes that that difficult times always expose weaknesses and can guide companies to improve. Such was the case with ACI as the pandemic revealed that their long-term forecasting capabilities were outmoded and overly dependent upon on-demand servicing.

Obtaining parts was difficult even before the pandemic and likely will be an on-going challenge in the future

ACI developed and implemented procedures to better anticipate customer needs, and expanded its maintenance portfolio to address those needs. Additionally, recognizing that obtaining parts was difficult even before the pandemic and likely will be an on-going challenge in the future, ACI has diversified and expanded its manufacturing options. Jensen has even explored additive manufacturing (AM), i.e. manufacturing some parts on site using 3D printer technology.

To address the ever-present need for qualified maintenance technicians, ACI worked closely with the administrators and educators at nearby Cuesta College to establish an Aircraft Mechanic Certification Program. The first cohort of 20 students commenced their course work in January 2023. Every graduate of the 19-month program is guaranteed a well-paying job. A second cohort will begin this summer. Already, the program is one of the most popular offerings at Cuesta.

Jensen credits the pandemic with strengthening ACI’s commitment to flexibility and adaptability. He believes ACI is better able now to pivot quickly as circumstances dictate; for example, rather than live with the long delays resulting from FAA inspection backlogs, ACI trained its own Designated Maintenance Examiners to handle these functions. While ACI continues to experience supply chain delays that keep aircraft grounded longer than desirable, Jensen believes ACI has emerged from the pandemic stronger, more flexible and more self-reliant than ever.

Conclusion

At their core, people in the aviation industry are problem solvers. It’s what they do, they keep working a problem until they succeed or perish. That is exactly what the MROs mentioned herein did in response to the pandemic. They worked the problem and, in each instance, succeeded. Each company weathered the pandemic and has moved on to the next challenge. Without question, there will be new challenges, but as long as companies meet them head on, pursue creative solutions and embrace the new opportunities that inevitably present themselves, we can be confident that aviation will prevail.

June 2023

Issue

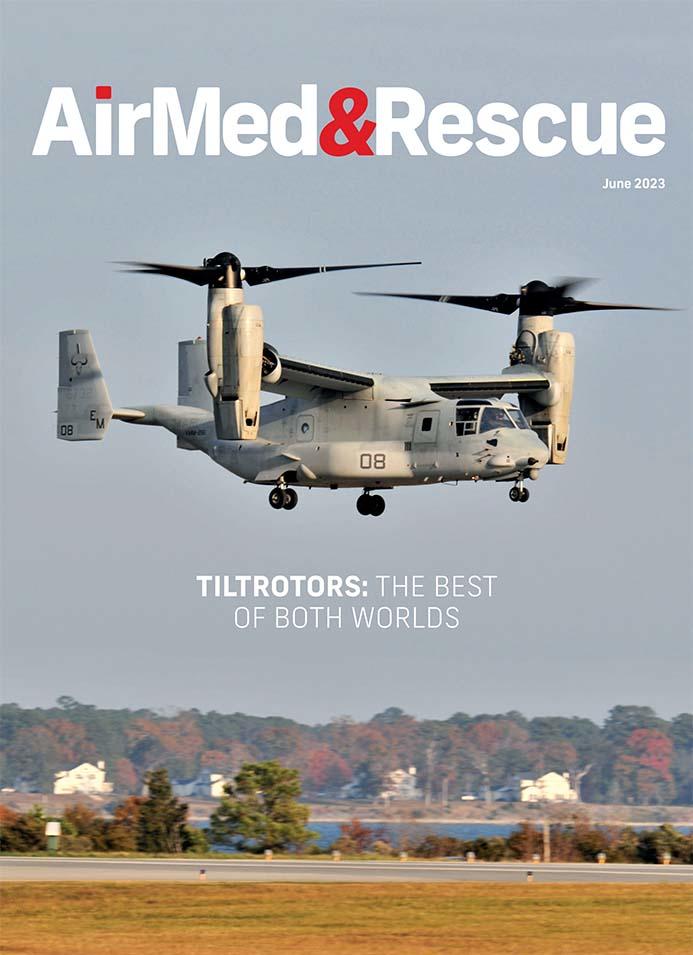

We find out about attracting the best staff; what is being done to improve sustainability; how tiltrotors compare with conventional aircraft; how rescue services approach sudden and extreme flooding; and the challenges facing MRO supply chains; plus all of our regular content.

David Pearl

David is a former Navy pilot and an attorney specializing in aviation law. He defended pilots, aircraft manufacturers, airlines, and aviation businesses including several significant jury trials.

Flying and airplanes are his passion. Now a freelance writer, David writes for a wide variety of clients on range of topics.