Government procurement and the tender process

Paul ‘Foo’ Kennard considers the pros, cons and pressures of government procurement

Governments are, in their simplest form, like very large private or public corporations. There are functional aspects that they complete ‘in-house’ with directly employed people and owned/leased equipment, and other functions where it is assessed to be better value for money to contract out for the provision of a service. There could be many reasons for this, such as the ‘market’ providing an element of competition to drive costs down. Or the need may be so specialized that only an existing, niche supplier can adequately fulfil the task – for the corporation or government to do so could prove uneconomic in time, effort and resource.

For a corporation, essential functions to contract out are facilities management and cleaning. There are countless smaller companies competing to offer the best service at the lowest bid price. From a government perspective, provisions are often similar (but on a vastly larger scale). However, more complex services are sometimes put up for tender by an external provider.

Airborne firefighting contracts in the US are an interesting example. From the perspective of the US Forest Service (USFS), it’s trying to drive down taxpayer costs via an initiative called Lowest Price Technically Acceptable (LPTA). For those unaware, the USFS has two types of contracting methods for provisioning aerial firefighting aircraft.

The first approach is to effectively have a ‘retained fleet’ on standby with agreed daily and hourly rates – in many respects, the equivalent of a ‘zero-hours contract’. The second is a far looser arrangement, activated when a fire reaches ‘campaign status’, and is termed ‘call when needed’ – exploiting all and any suitable airframes from providers not on retained status.

There is a subtle differential between price and value. Getting it wrong can have calamitous impacts

Following the money

The ‘retained’ contracts are funded from the USFS’ core budget, and this is where LPTA contracts are being introduced – the aim being to drive down costs and encourage potential suppliers to partake in, effectively, a bidding war. Many in the industry, such as Bob Jorgenson at Timberline, observe that this ultimately helps nobody.

To remain competitive, the industry must reduce overheads. Companies will be incentivized to employ lower-trained and lower-paid pilots to use smaller, less expensive platforms, eschewing investment in advanced capabilities crews, trained on night vision systems and the required Supplemental Type Certificated (STC) cockpits. The latter is an important consideration; crews and platforms certified and qualified to fly at night could conceivably quench a small fire soon after it starts. By morning, perhaps some hours later, it may have rapidly spread into a far more serious conflagration, costing significant resource to contain and suppress.

A tender can only be as good as those drafting it and will inevitably reflect current circumstances

By contrast, once deemed to have reached ‘campaign’ status, a fire can now receive federal support to activate ‘call when needed’ aircraft. The USFS budget strain is eased, and the day/flight hour rates are far more generous. Several of the larger companies are now moving away from ‘retained’ contracts, as they simply cannot compete with the leaner, ‘meaner’, more aggressive pricing of the smaller bidders – often family businesses with a single aircraft and low overheads.

Isn’t this exactly what the USFS tender process is supposed to deliver? Well, yes and no. The ‘yes’ is their budgetary numbers will be improved. The ‘no’ is that the reliance upon the ‘call when needed’ resource could leave the USFS horribly short of assets come the next ‘gigafire’. There is little doubt that climate change is having a material impact upon conditions in other countries outside the US. Recent wildfire seasons in Australia, Chile, Czech Republic, Spain, Portugal, Italy and Greece have all exceeded historical norms. Governments are scrambling to increase their aerial firefighting provision – and, more importantly, are willing to pay for it.

Several North American companies have been shipping platforms and crews around the world on a seasonal basis to help plug this gap. Coulson Helicopters has been contracted by the Australian government to move across Chinook and S-61 helicopters for the next three annual seasons, and they have also deployed aircraft as far afield as Chile. Others have started to redeploy firefighting assets onto other utility tasks, lowering pilot currency, often meaning the aircraft is geographically remote if needed.

The downstream consequence is that the LPTA tendering process may, at a moment of ultimate distress, result in few, if any aircraft responding swiftly to a ‘call when needed’. This will lead to far greater damage and loss of life than what may have been the case with a different tendering approach. In an extreme case, the potential loss could be a whole city.

The bottom line is often easy to calculate – it’s the second and third order consequences that need nuance and consideration. This requires those drafting the tenders to be Suitably Qualified and Experienced Personnel (SQEP) in the contracted activity, not merely commercial officers trying to deliver the cheapest price. There is a subtle differential between price and value. Getting it wrong can have calamitous impacts.

Contract crisis

Closer to home, and making unwelcome headlines in the UK, is the Military Flying Training System (MFTS) contract. The UK Ministry of Defence used to wholly own the flying training system, including training, employing the instructors and support staff, providing airfields and infrastructure, and purchasing and maintaining the fleet of aircraft and simulators. All of this was expensive for the public purse, but through the decades of the Cold War, it was considered necessary.

The rapid collapse of the Soviet Union placed pressure on governments to reduce defence spending; a ‘Peace Dividend’ was demanded and delivered. From the mid-1990s, elements of the training system were externally contracted slowly. Finally, as an output of the 2010 Defence Review, the remainder of UK flying training was tendered out. Assumptions underpinning the tender were in good faith at the time, but have proven significantly in error, as the focus appears to have been on price/cost rather than a more rounded provision.

A tender can only be as good as those drafting it and will inevitably reflect current circumstances. MFTS was specified at a time of historic low requirement; the Strategic Defence Review had cut a swathe through platform numbers to balance the books after the financial crash and, not unreasonably, the tender was written accordingly by a specifically assembled team. The direction to focus on terms and conditions and pricing, it seems, precluded the inclusion of adequate clauses for future expansion.

Subsequent events – not least a resurgent and bellicose Russia – have put pressure on MFTS to deliver increased output. This is to match both a rapid reinvestment in more platforms and a need to cover-off a pilot shortfall, effectively papered over by crews not leaving and others rejoining, due to the impact Covid-19 had on the airline market. The UK now has a backlog of some 300 pilots in the training pipeline, with a shortage of instructors to teach them. This results in students burning valuable flight hours every year in ‘refresher’ periods between training courses, placing even greater strain on output.

This MFTS crisis has reached the highest levels of political attention – proof, if any were needed, that contracting ‘on the cheap’ may result in favourable reports for those that deliver a viable product on budget, but that replacements often pick up the pieces when assumptions change and there’s not the ‘commercial wiggle room’ or in-house resource to deal with it.

In sum, get the tender wrong, set your requirements at a hopelessly optimistic level, have insufficient capacity to expand and suddenly you’re making headlines for all the wrong reasons. People are placed under pressure to deliver more with less; in aviation that’s a very dangerous place. In the best case, good employees leave and seek a role elsewhere. In the worst case, it results in an accident.

I’ve been on the ‘wrong end’ of the tender process. An aviation company where I held a senior appointment was suddenly confronted by a tender process for a contract that, hitherto, had been awarded ‘sole source’. Those that see the benefits of a tender in terms of encouraging competition perhaps fail to understand the impact it can have on a Small and Medium-Sized Enterprise (SME). Simply responding to a tender is a non-trivial exercise; it takes a disproportionate amount of staff effort, which is therefore not applied to running the business or seeking other opportunities. A company’s senior staff must read and understand what the tender is asking, often decomposing the daunting pile of paperwork into easier to manage ‘chunks’. Any ‘Response to Tender’ must answer the question being asked, and if proceeding to the formal bid stage, the bidder must explain how they will deliver the required output, at what price and in adherence to mandated terms and conditions. It’s a lot of work, and must be done accurately lest your bid fails, and effort therefore wasted, on a technicality.

In larger corporations, this ‘bid process’ can run into several months and six-figure sums in internal ‘overheads’ – making an early ‘bid/no-bid’ decision vital. For our SME, we had to make a difficult decision. If we bid and lost, the cost and distraction might leave the company poorly placed financially, with insufficient revenue to maintain the company ‘as is’. To not bid would give us the opportunity to work out the contract, maintaining both revenue stream and reputation, while attempting to seek alternate sources of income. It was only by spending a bit of valuable time dissecting the bid that we were able to reach the reluctant conclusion of ‘No Bid’. The tender process in this case had dis-incentivized us to stay engaged, but perhaps the tendering agency got what they wanted in a new supplier.

Happily, for some of our highly qualified employees, the winning bidder agreed to pick up their contracts. While done on a business-to-business basis, with our staff’s interests at heart, other mechanisms exist to ensure that the passing of a tender from one company to another does not have an unnecessary impact. In the UK, a process known as Transfer of Undertakings (Protection of Employment), known as ‘TUPE’, helps to safeguard staff if a contract is awarded to a new bidder, or the company they work for is bought out. Would-be tenderers are well advised to determine if TUPE is in effect before bidding – especially if it’s a government contract they are seeking.

No tender process is perfect. There will inevitably be winners and losers, and even the best-qualified and motivated personnel can make incorrect assumptions at the tender framing stage – errors that sometimes manifest themselves several years after the tender was let. Likewise, those ‘Responding to Tender’ need to think long and hard about what is being asked and weigh-up the relative merits of bidding, aware of the inherent risks.

Ultimately, ‘tender feelings’ can quickly become ‘bruised feelings’ on both sides if the Invitation and Response to tender do not meet the standards required – resulting in expectations not being met and fingers being pointed. Get it right, however, and a value-for-money provision can be secured, to the benefit of all concerned.

November 2022

Issue

Cockpit automation heightens safety, the move by air medical providers to longer-range jets, the standardization of infectious disease patient transfers, and electronic communication in the Mediterranean Sea helping to aid refugee rescues

Paul 'Foo' Kennard

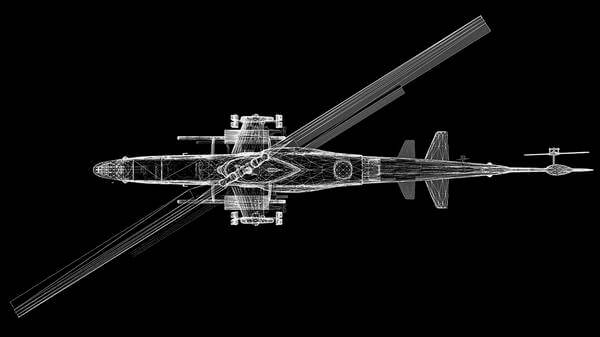

Paul 'Foo' Kennard is an Independent Aerospace & Defence Professional, and former RAF chinook pilot